401k tax penalty calculator

The IRS charges a penalty for various reasons including if you dont. In the example above youll pay.

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401 k or even your IRA versus rolling it over to a tax-deferred.

. If you leave a job you can roll your 401 k into a new 401 k or an IRA at an online brokerage or. File your tax return on time Pay any tax you. 55 or older If you left.

For example if you are looking to withdraw 20000 from your 401k and your tax rate is 20 expect to only take home 14400. In terms of a penalty you will pay a 10 percent amount for an early withdrawal based on your age and other factors according to the IRS. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. Whatever Your Investing Goals Are We Have the Tools to Get You Started. 401k Withdrawal Tax Penalty Calculator Using the sales tax can also be a solution if you do not agree with the results of your audit of you want to appeal.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator Results. How We Calculate the Penalty. When considering making an early withdrawal from your retirement savings it is important to understand the potential impact of such a decision.

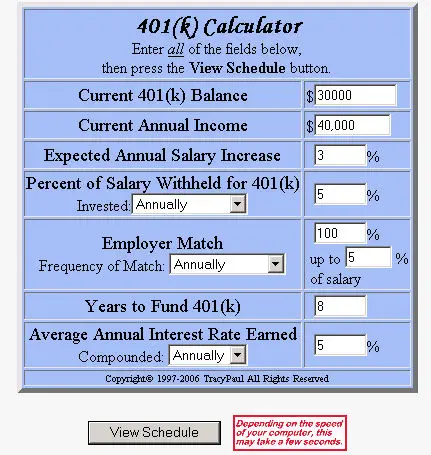

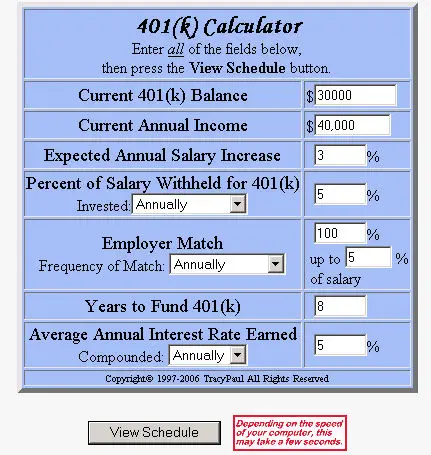

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Our sole and only guarantee or warranty is that anyone who influences us to change our algorithm by more than ten cents 010 will.

Dont Wait To Get Started. Taxpayers who dont meet their tax obligations may owe a penalty. Another aspect is covered in the.

We have the SARS tax rates tables. In general distributions prior to age 59½ will be hit with a 10 penalty and income taxes. Discover The Answers You Need Here.

Ad If you have a 500000 portfolio download your free copy of this guide now. In some cases its possible to withdraw from retirement accounts like 401ks and individual retirement accounts before your retirement age without a penalty. Distributions from your QRP are taxed as ordinary income and may be.

Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. Retirement Plan Withdrawal Calculator.

Ad If you have a 500000 portfolio download your free copy of this guide now. Our IRS Penalty Interest calculator is 100 accurate. Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plan among others can create a sizable tax.

We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a. 2000 would go to the.

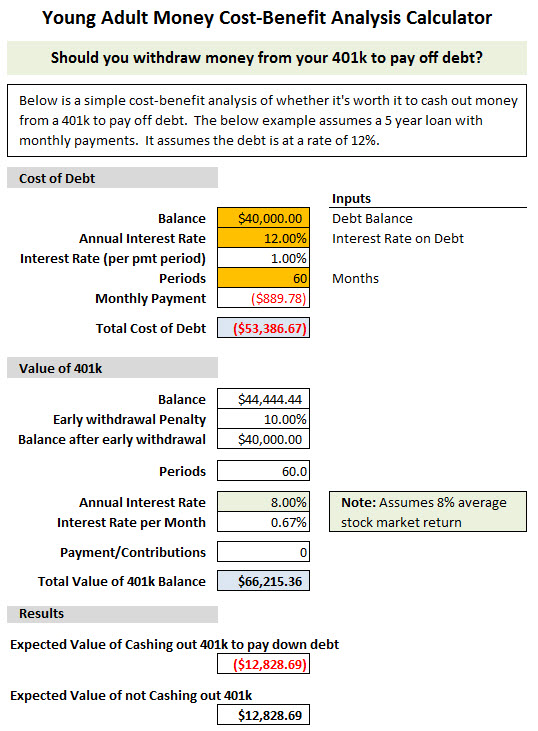

Should You Cash Out Your 401k To Pay Off Debt Free Calculator Download Young Adult Money

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Beware Of Cashing Out A 401 K Pension Parameters

How To File Irs Form 1099 R Solo 401k

401k Retirement Withdrawal Calculator Outlet 60 Off Www Ingeniovirtual Com

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

401k Calculator

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

401 K Inheritance Tax Rules Estate Planning

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

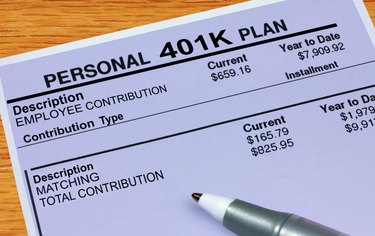

Free 401k Retirement Calculators Research401k

401 K Calculator Credit Karma

How To File Taxes On A 401 K Early Withdrawal

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Bear Markets And Your 401 K

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling